Small Business Valuation Methods Guide

Trying to figure out the value of your business can feel like standing in the middle of a maze—every turn leads to a different answer. You’ve probably asked yourself, “Which business valuation method is best?”

This guide is here to break it all down for you. You’ll learn about each valuation method, how they work, when to use them, and most importantly—how to make the right choice for your business. Let's demystify the valuation maze.

Understanding and Applying the Main Valuation Methods

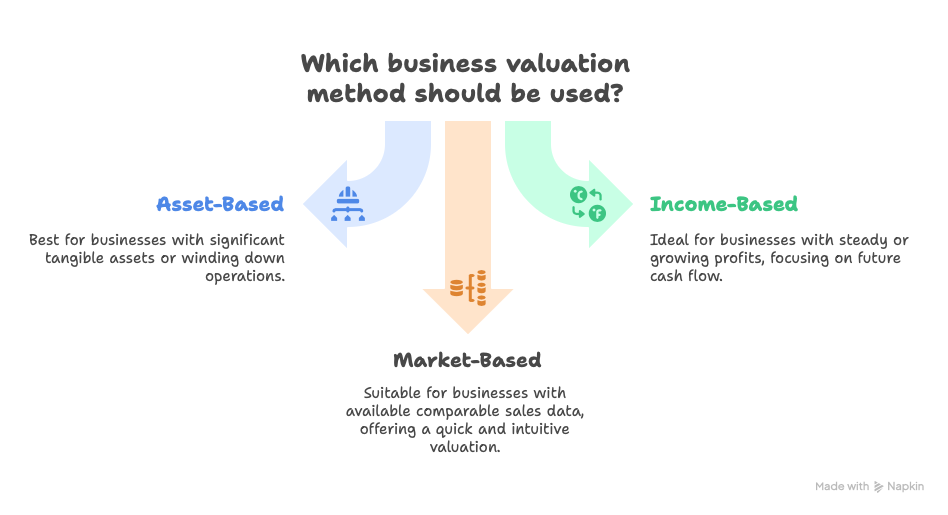

Let’s keep it simple. There are three main ways to value your business: Asset-Based, Income-Based, and Market-Based.

Asset Based

This method focuses on what you own—your assets—and subtracts what you owe. Think of it as taking inventory of everything: buildings, equipment, cash, and even intangible stuff like patents.

Income Based

Income-Based Valuation is all about what your business earns. It looks at future cash flow or earnings and discounts them to present value. Methods like Discounted Cash Flow (DCF), Capitalization of Earnings, and Earnings Multiples fall into this category. These methods are ideal for businesses with steady or growing profits. They’re forward-looking and widely accepted—but they also require a lot of assumptions and number crunching.

Market Based

Market-Based Valuation compares your business to similar ones that have sold. It uses real-world transactions to establish value. This can be fast and intuitive, and it's widely recognized in practice. Still, it depends heavily on the availability and quality of comparable sales data, which can be a problem for small or unique businesses. And it may overlook key aspects like profitability or uniqueness.

Dispelling the Myth of a "One-Size-Fits-All" Valuation Method

There is no universal method that works for every business. Relying solely on one approach—especially market-based methods—can be misleading.

Market Based Valuations

Market-based valuation is often problematic for small businesses due to a lack of quality comparable data. Small firms are rarely identical. Your business might serve a niche market, have a unique operating model, or rely heavily on the owner. These characteristics make it hard to find true comparables. Add in changing market conditions, overgeneralized multiples, and subjective assumptions, and you're left with an estimate that might miss the mark.

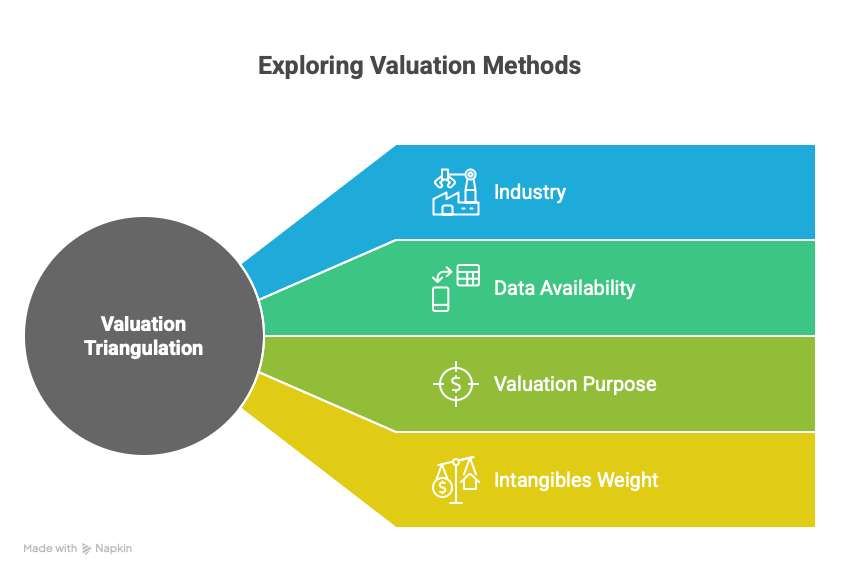

Triangulation

Triangulation or using multiple methods—is often the smarter move. It allows you to compare results from different lenses and arrive at a more informed, balanced valuation. Your choice of methods should reflect your industry, the available data, the purpose of the valuation, and the weight of intangibles in your business.

If you're preparing for a sale, for example, you may lean into income-based or market-based approaches. If you're planning a liquidation, asset-based is probably more appropriate. The key is context. Ask yourself:

• What kind of data do I have access to?

• Is my business asset-heavy or driven by profits?

• Am I prepping to sell, attract investors, or just curious about my business worth?

There’s no shame in mixing methods. In fact, it’s the most accurate path forward

Why Professional Guidance is Indispensable

Let’s be honest: business valuation isn’t a DIY project for most people. Sure, you could read all the blogs and download templates. But will that give you the nuance you need?

Probably not.

Hiring a professional—like a Certified Business Appraiser, a financial advisor, or a CPA—can make a huge difference. They don’t just plug numbers into formulas. They:

• Adjust your financials to reflect real-world operations

• Select the right discount or capitalization rates for your industry

• Compare multiple methods and help you understand what the numbers actually mean

Think of them as your valuation translator. They bridge the gap between numbers and value.

So, if the stakes are high—like a sale or an investor pitch—get help. It’s not just about getting a number. It’s about getting the right one.

Final Thoughts

Here's the bottom line: there’s no perfect, one-size-fits-all method for valuing your business. And that’s okay.

By understanding the three main approaches—asset-based, income-based, and market-based—and knowing when to use each, you’re already ahead of the curve. Better yet? You’re thinking strategically.

Want to make sure you're choosing the right business valuation method for your goals? Start by asking the right questions. Then talk to a pro. That way, you’ll get a number that actually makes sense—and helps you move forward with confidence.

Social accounts

Get in touch

-

2180 Third Street, La Verne, CA, 91750

-

SBDC@laverne.edu

-

(909)448-1567