Navigate Risks: Small Business Contingency Planning That Actually Works

Let’s be honest—if your business faced a major disruption tomorrow, would you be ready? Or would you scramble to figure out what to do?

Too many small business owners rely on a patchwork of insurance policies, crossed fingers, and vague ideas about what they’ll do “if something happens.” That’s not a plan. It’s a gamble.

Real protection comes from a living system. One that evolves with your business. One that not only prepares you for emergencies but positions you to grow stronger because of them.

That’s where small business contingency planning comes in. This guide will help you build a Business Resilience Plan that’s practical, adaptable, and designed to help you navigate risks—not just react to them.

Why Small Business Contingency Planning Isn’t Optional

You don’t need a crystal ball to know risk is part of the game. Every small business—whether you’re running a bakery, a tech startup, or a solo consultancy—faces threats.

Some are obvious. Fires, floods, and cyberattacks can grind your operations to a halt. Others are more subtle, like a supplier going under or losing your top employee. Either way, the impact can be devastating if you're caught off guard.

But the good news? Most risks are manageable—when you plan ahead.

Having a contingency plan gives you a roadmap. It protects more than your assets. It safeguards your cash flow, your reputation, and the relationships that keep your business running.

Let’s say a wildfire forces you to close your storefront. With the right plan, you’ve already arranged for remote fulfillment and customer communication. You don’t just survive the event—you keep your clients, and their trust, intact.

And risk doesn’t always come from disaster. Growth can be risky too. Say your product goes viral or you land a big new contract. Without the systems in place to handle that surge, opportunity can turn into chaos. Smart contingency planning helps you seize growth without losing your footing.

The Foundation: A Business Resilience Plan Built to Adapt

So what makes a risk strategy work?

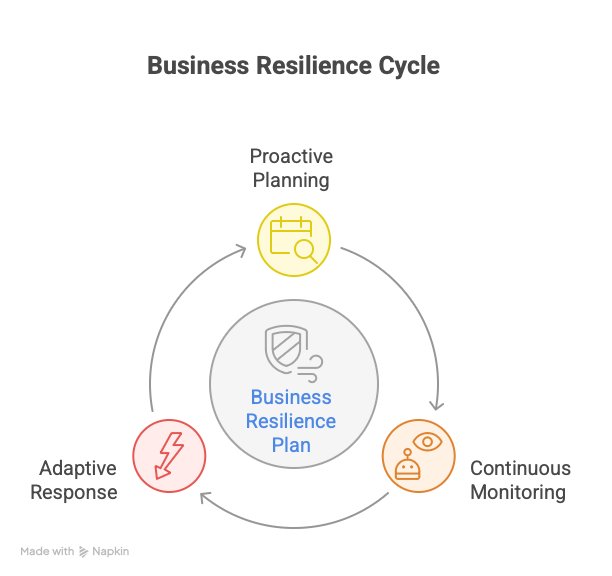

It's not a static checklist. It’s a flexible, ongoing process. A Business Resilience Plan that evolves with your business and reinforces itself through three core actions:

• Proactive Planning: You anticipate and prepare before a disruption hits.

• Continuous Monitoring: You keep tabs on internal and external signals of risk.

• Adaptive Response: You act fast, adjust quickly, and learn every time something happens.

These aren’t nice-to-haves. They’re essentials if you want to lead a resilient company that grows despite challenges.

Proactive Planning: The Step You Can’t Skip

Planning starts with knowing what could go wrong. So ask yourself: what are the real threats to your business?

Some are internal—like equipment failure, staff turnover, or cash shortages. Others are external: natural disasters, market changes, or supply chain issues. And then there are the opportunities that can become threats—like unexpected growth, a big client onboarding, or rapid regulatory change.

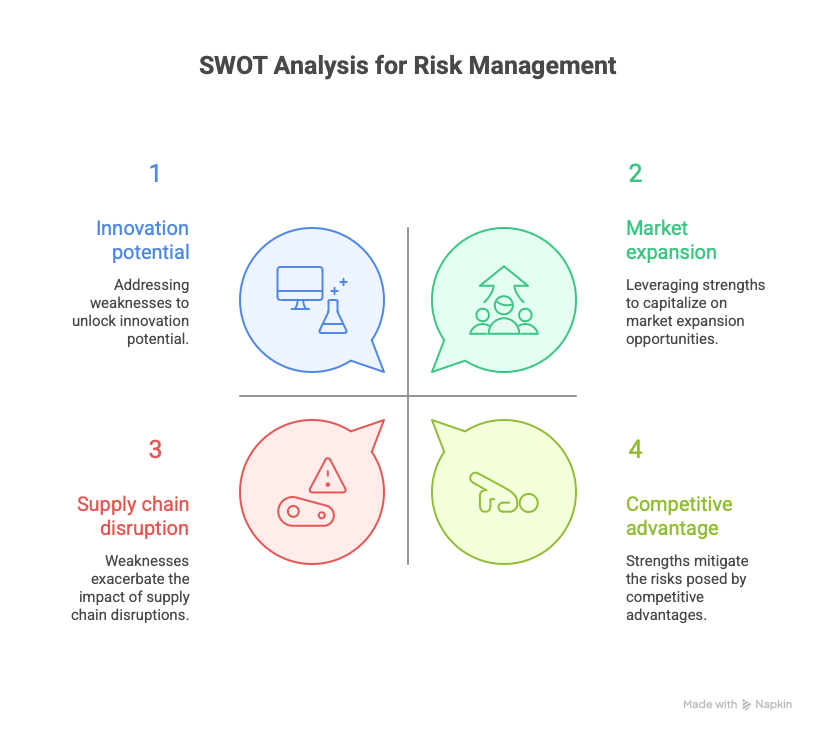

Start by mapping your vulnerabilities. A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is a simple but powerful tool here. It helps you think beyond the obvious and consider hidden risk factors.

Next, prioritize. Not all risks are equal. A late invoice is annoying. A cyberattack that compromises customer data? That’s serious. Use a Business Impact Analysis (BIA) to figure out which risks would hurt the most—financially and operationally.

Now build your response. Will you avoid the risk? Mitigate it? Transfer it with insurance? Or accept it and monitor closely? For example:

• Rely on a single vendor? Identify two backups.

• Run a retail shop? Prepare a plan for temporary online operations.

• Depend on one person for a mission-critical task? Cross-train another team member.

And don’t forget the long view. Your plan should include what happens if you can’t run the business. Retirement, illness, or an unexpected exit are uncomfortable to think about—but critical to prepare for.

Continuous Monitoring: Stay Alert or Stay Exposed

Creating a plan isn’t enough. You have to keep it relevant.

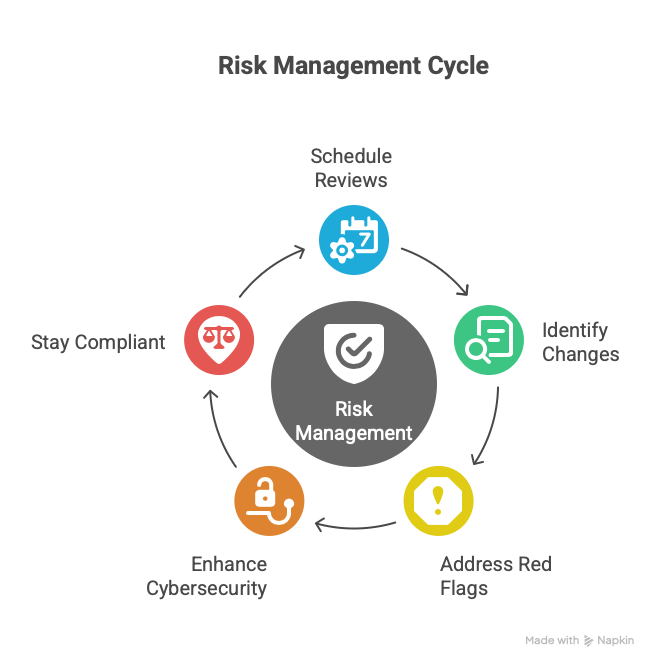

Set a schedule—twice a year at minimum—to review and update your risk assessment. Think of it like a financial audit or a strategic planning session. It’s that important.

Things change. New risks emerge. Staff turnover, tech upgrades, policy shifts—each one can affect your exposure.

Plus, risks often send warnings before they explode. Are your margins getting tighter? Are you suddenly relying on just one or two big clients? Is employee turnover creeping up?

Red flags like these deserve your attention. And so do operational oddities—unexplained timecard edits, irregular financials, or missing inventory. These are signals, not flukes.

On the tech side, lock it down. Cybersecurity isn’t just an IT problem—it’s a business continuity issue. Train your team. Use multi-factor authentication. Back up your data in multiple locations.

And always know the rules. Regulations change—especially if you’re in healthcare, food service, or finance. Stay current to avoid surprise fines or shutdowns.

Adaptive Response: Act Fast, Learn Faster

When something happens, your plan should tell you exactly what to do—and who needs to do it. Let’s say your building floods. Do you shift operations to a backup location? How do you notify customers? Who takes the lead? Your response doesn’t need to be perfect. It just needs to be fast, calm, and coordinated.

And once the dust settles, don’t just move on. Learn. Debrief your team. Document what worked and what didn’t. Update your plan based on what you’ve learned. Every incident is a chance to build a stronger, smarter business.

Daily Integration: Make Risk Management a Business Habit

Don’t treat your plan like a fire extinguisher—only useful in emergencies. Make it part of how you run the business.

Start with your business plan. Add a section on risk. Spell out the contingencies for your operations, your finances, and your people.

Involve your team. Hold quarterly check-ins to review risks. Update SOPs. Cross-train staff so you're not vulnerable if someone leaves or gets sick.

Tap into expert help. The SBA, your CPA, your lender, and your insurance broker all bring valuable insights. Confirm your bank is FDIC-insured and verify your coverage.

Build financial cushions. A one-month cash reserve can buy you time in a crisis. Don’t max out your credit lines—leave room for the unexpected.

Operationally, standardize the essentials. Set procedures for key tasks. Evaluate your vendors regularly. Maintain your space. Revisit your exit strategy.

This isn’t about adding more work. It’s about preventing avoidable chaos later.

Final Thoughts

You can’t eliminate risk—but you can navigate risks with strategy and confidence.

Small business contingency planning is your edge. It turns uncertainty into opportunity. It helps you respond with clarity instead of panic. And it keeps your business stable—so you can focus on growth, not damage control.

So don’t wait.

Review your plan. Talk to your team. Run a what-if scenario. You don’t have to predict the future. You just have to prepare for it.

And now, you know exactly how.

Social accounts

Get in touch

-

2180 Third Street, La Verne, CA, 91750

-

SBDC@laverne.edu

-

(909)448-1567