Commercial Lease Basics: What Every Small Business Owner Should Know

Oct 29

/

Sean Snider

Leasing a commercial space is one of the biggest commitments a small business will make. The right lease can set you up for success, while the wrong one can hold you back for years. Here’s a roadmap to help you understand what to look for, what to avoid, and how to protect your business.

As we get started, I want to make sure readers know that the information provided in this blog post is for general educational and informational purposes only and should not be considered legal, financial, or professional advice. Readers are encouraged to consult with a qualified attorney, real estate professional, or financial advisor before making any decisions regarding commercial leases or related matters.

As we get started, I want to make sure readers know that the information provided in this blog post is for general educational and informational purposes only and should not be considered legal, financial, or professional advice. Readers are encouraged to consult with a qualified attorney, real estate professional, or financial advisor before making any decisions regarding commercial leases or related matters.

Getting Ready to Lease

Leasing a commercial space is a long-term commitment and like anything long-term (a year or more) you want to give it some careful thought and consideration.

Can you afford it?

Rent is expensive and long-term. Thus, we need to plan it out in a business plan or a financial forecast to make sure we know we can afford the rent and still make money after all our other expenses. At the planning stages, we can work with a “placeholder” or an anticipated amount that we expect the rent to cost and refine it as we move through the process. In a nutshell, we need to know how many widgets or billable hours we will need to sell to break-even considering our rent and other operating expenses.

Many entrepreneurs skip this step because it isn’t as fun or exciting as building out a space and selling, but as the old adage goes “failing to plan is planning to fail”. So, please take a moment to meet with one of our SBDC consultants to review the numbers - after all it is free.

Many entrepreneurs skip this step because it isn’t as fun or exciting as building out a space and selling, but as the old adage goes “failing to plan is planning to fail”. So, please take a moment to meet with one of our SBDC consultants to review the numbers - after all it is free.

Building Your Team

Many small business owners don’t know that they can get the help of a commercial real estate agent/broker for free when they are looking for space to lease. In most cases, the landlord or the property owner pays the brokerage commission, which is split between the landlord’ listing agent and the tenant's agent.

For example, if you sign a 5-year lease at $5,000/month, the total lease value is $300,000. A 4% commission would be $12,000, usually split between the landlord’s broker and your “tenant rep” broker. So having an agent doesn’t make the deal more expensive for you — it just ensures someone is advocating for your interests.

For example, if you sign a 5-year lease at $5,000/month, the total lease value is $300,000. A 4% commission would be $12,000, usually split between the landlord’s broker and your “tenant rep” broker. So having an agent doesn’t make the deal more expensive for you — it just ensures someone is advocating for your interests.

That said, choosing the right broker can make all the difference in your leasing experience. Start by looking for a broker who specializes in the type of space you need — retail, office, or industrial — and who regularly works with small businesses. Ask other local business owners for referrals, check with your local chamber of commerce and check online reviews. Meet with at least two or three brokers to compare their approach, market knowledge, and communication style. The right broker should listen to your goals, explain your options clearly, and act as your advocate in negotiations, not just try to close a deal quickly.

Aside from a broker, you’ll want to work with the city because zoning laws, permits, and use restrictions can make or break your lease. Always check with the city planning department before signing — you don’t want to discover after the fact that your business type isn’t permitted or there are other issues that would prevent you from opening. Typically, there are city staff members with the title of “Community & Economic Development” that can provide key insights into not only the property you may be considering, but also future city developments and/or the history of the unit that will be useful to you as a business owner. These are the folks who can tell you where the “bodies are buried” if you are nice to them. So be nice!

Lastly, you’ll want to have a general contractor that is specialized in commercial tenant improvement projects. This is because once you find a space it will likely require some tenant improvements (also referred to as “TI” or leaseholder improvements) and you’ll need to cost this out by doing job walk of the unit with a contractor to see how much it’s going to cost to get the space ready to operate the business.

Searching for the Right Space

Need-to-Have’s & Nice-to-Have’s

Before we move into searching for space we first need to sit down and think about our business and develop a list of need-to-have’s and nice-to-have’s. This will be essential to not only refine our search, but it also shows a broker that we’re serious and it can also help us evaluate our options. For example, a need-to-have might be a certain square footage for operations, storage and customer areas, whereas a nice-to-have might be green space or outdoor seating if it’s not critical to your operation.

Restaurants often plan their space based on a table-turn model. For example, if a restaurant averages $25 per customer and seats 50 guests at a time, a full seating generates about $1,250 in sales. If the restaurant can turn those tables three times in an evening, total revenue for that day is $3,750. This is why the number of tables, seating layout, and customer flow are critical when evaluating whether a space can realistically support your revenue goals.

I often tell clients that they better love the space because they are going to be spending so much time there (in their business) that if they don’t love it, it will be difficult to want to spend the time there that it will take to make your business successful. Look for that “oooo…oh yeah” feeling.

Research Tools

Sites like LoopNet, Crexi, and CoStar can help you see what’s out there, but don’t rely only on them. Many great spaces never hit the open market — another reason a broker is valuable.

In terms of timing, most small businesses underestimate how long it takes to secure the right location. On average, expect 3–6 months just to search and negotiate a lease. If you need a specialized build-out (like a restaurant kitchen or fitness studio), the process can stretch to 9–12+ months once city permits and construction are factored in. To avoid last-minute stress, begin your search at least a year before you need to move in.

Setting up a free account on these listing platforms allows you to save your search criteria and turning on notifications, gives you instant alerts when new properties hit the market that match your needs—helping you stay ahead of the competition. These platforms also let you track saved listings, compare spaces side by side, and access additional details like lease terms and broker contacts, making the search process more efficient and organized.

In terms of timing, most small businesses underestimate how long it takes to secure the right location. On average, expect 3–6 months just to search and negotiate a lease. If you need a specialized build-out (like a restaurant kitchen or fitness studio), the process can stretch to 9–12+ months once city permits and construction are factored in. To avoid last-minute stress, begin your search at least a year before you need to move in.

Property Types

Not all centers are created equal. Understand the differences between strip centers, lifestyle centers, malls, and stand-alone retail. Each attracts different customers and comes with different costs and responsibilities.

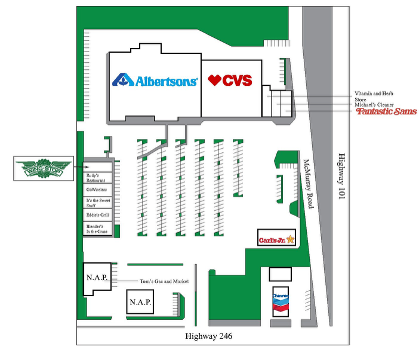

Big Box Centers

These retail hubs are anchored by one or more large-format stores such as Walmart, Target, or Home Depot. They attract value-driven, convenience-oriented shoppers who prefer one-stop shopping for essentials and home goods. Costs often include higher common area maintenance (CAM) fees due to large parking lots and shared infrastructure, and tenants may be required to comply with stricter signage and façade guidelines to align with the anchor tenant’s brand standards.

Regional Malls

Enclosed malls with national department stores or fashion anchors, regional malls pull a wide demographic of customers seeking a mix of shopping, dining, and entertainment. They often generate strong foot traffic but come with high rent and marketing contributions, as well as strict operating hours and tenant mix restrictions enforced by mall management. These centers also require tenants to invest heavily in buildout and store design to meet aesthetic requirements.

Lifestyle Centers

Open-air developments featuring a curated mix of higher-end retail, dining, fitness, and entertainment, lifestyle centers attract affluent, experience-driven customers who value ambiance and brand mix as much as the products themselves. Tenants often face higher buildout costs, stricter design guidelines, and premium rents to match the upscale positioning. These centers also place greater emphasis on events, landscaping, and amenities, which tenants indirectly support through elevated CAM fees.

Neighborhood Centers

Typically anchored by a grocery store or pharmacy, these centers attract local residents who shop frequently and prioritize convenience. Costs tend to be lower than malls or lifestyle centers, but tenants may face responsibilities like maintaining consistent hours, contributing to parking lot upkeep, and adhering to co-tenancy clauses tied to the anchor’s performance. These centers offer steady, repeat traffic but rely heavily on the success of the anchor tenant.

Understanding the Lease

Key Lease Structures & Clauses

The most important thing you can do before you sign a lease is read it. Many people are intimidated by lengthy documents and business jargon, but grab a cup of coffee and give it a read through and jot down or highlight sections that you’re not sure about. For the sections you don’t quite understand, be sure to ask for clarification and use AI tools like ChatGPT to help break things down in a manner that is easier to understand. Just be sure not to enter into ChatGPT any confidential information. One of my favorite things to do is take a complex concept or paragraph full of business jargon and ask ChatGPT to explain it to me like I’m five years old. You’d be surprised how well it does this.

Common Types of Leases

There are four common types of commercial leases; a gross lease (full-service), a net lease, a modified gross lease and a percentage lease. The primary difference between these types is the allocation of operating expenses between the landlord and tenant. Here is a breakdown of the common types;

Gross Lease (Full-Service Lease)

The tenant pays a single, fixed rent amount, and the landlord is responsible for paying all or most of the operating expenses, such as property taxes, insurance, and maintenance.

Net Lease

A lease where the tenant pays a base rent plus some or all of the property's operating expenses. There are three main types:

Single Net Lease: Base rent + property taxes.

Double Net Lease: Base rent + property taxes and insurance.

Triple Net Lease: Base rent + property taxes, insurance, and maintenance costs.

Modified Gross Lease

A hybrid between a gross lease and a net lease. The tenant pays a base rent plus a portion of the operating expenses, with the specific costs detailed and negotiated in the lease.

Percentage Lease

The tenant pays a base rent plus a percentage of their gross sales.

It is really important to define what is considered gross sales. For example, sales taxes and tips are sometimes included, but really aren't part of the business’s income.

It is really important to define what is considered gross sales. For example, sales taxes and tips are sometimes included, but really aren't part of the business’s income.

Common Lease Clauses

An easy way to get comfortable with reviewing leases and feel more confident is by reviewing sample leases. Commercial leases come in a variety of shapes and sizes. Once you’ve had a chance to see a few - you’ll quickly see how some are very informal (short) and others are very formal and lengthy. Here are a few sample commercial lease agreements from eforms.com, rocketlawyer.com, lawdepot.com, etc..

Nonetheless, there are some common clauses that you’ll encounter when reviewing a commercial lease. Let’s take a look at a few to get familiar with them and why they’re important;

Parties

This section identifies who is legally bound by the lease. Only the individuals or entities named here will have the rights and obligations under the agreement. For business owners, it’s critical to list the official legal name of your business entity (LLC, corporation, etc.) rather than your personal name. If you sign personally, you could be held personally liable for all lease terms and conditions. In most leases, the landlord is referred to as the “Lessor” and the tenant as the “Lessee.”

Premises

This section describes the space you’ll be leasing. Make sure this section describes every part of the property you’ll use. You should specify the exact square footage of the space because the landlord might use this figure to determine your portion of other expenses like real estate taxes, etc. If this section says you’ll accept the premises “as is”, be sure to thoroughly inspect the space and consider including verbiage below to ensure the property is in good condition;

“The premises shall be delivered to Tenant in good, clean and tenantable condition, with all building systems working, and in compliance with all applicable laws in effect as of the Occupancy Date.”

“The premises shall be delivered to Tenant in good, clean and tenantable condition, with all building systems working, and in compliance with all applicable laws in effect as of the Occupancy Date.”

Lease Term

This section should be straight forward and detail what you’ve discussed with the landlord, but it can get a little confusing with terms like “effective date”, “commencement date” and “occupancy date”. In a nutshell;

Effective Date – the date you sign the lease

Consider adding verbiage to this section that describes that if the Landlord has fails to deliver the premises to the tenant in the condition required by the lease by [insert date] that the rent shall be reduced proportionately for each day of delay.

Effective Date – the date you sign the lease

Commencement Date – the date you begin making improvements, if applicable.

Occupancy Date – the date you move into the space.

Consider adding verbiage to this section that describes that if the Landlord has fails to deliver the premises to the tenant in the condition required by the lease by [insert date] that the rent shall be reduced proportionately for each day of delay.

Rent

This is one of the most critical sections of a commercial lease and the details should be spelled clearly. How much you will pay in rent each month, when it is due and how you will pay it.

Here it is important to confirm not just the amount, but how it is calculated (per square foot or flat monthly), and if it is consistent with what was negotiated.

Typically, rent is due “in advance” or on the 1st of the month. If there will be a period of tenant improvements, try to negotiate a lower rent during this period because your business will not be making money during construction.

Here it is important to confirm not just the amount, but how it is calculated (per square foot or flat monthly), and if it is consistent with what was negotiated.

Typically, rent is due “in advance” or on the 1st of the month. If there will be a period of tenant improvements, try to negotiate a lower rent during this period because your business will not be making money during construction.

Rent Escalations

This section outlines how and when rent will increase over the term of the lease. Landlords use this clause to keep pace with rising operating costs, inflation and other factors affecting property value. Your lease may contain rent increases due to real estate taxes, operating expenses, or annual increases that are fixed or tied to the consumer price index.

Make sure you understand how increases are calculated and that you’re only responsible for the percentage of increased costs that corresponds to the square footage of your leased premises. It’s important to clarify the timeframe in which you are expected to pay any costs and any documentation that the landlord will need to provide you to justify the escalations.

Make sure you understand how increases are calculated and that you’re only responsible for the percentage of increased costs that corresponds to the square footage of your leased premises. It’s important to clarify the timeframe in which you are expected to pay any costs and any documentation that the landlord will need to provide you to justify the escalations.

Common Areas

The “Common Areas” clause in a commercial lease refers to spaces shared by the landlord and all tenants, such as parking lots, hallways, stairwells, lobbies, restrooms, landscaping, and building entrances.

This section outlines how those areas are maintained, who controls them, and how costs are shared among tenants. When reviewing this clause, small businesses should pay attention to the landlord’s obligations and the tenant’s responsibilities. For example, leases often give landlords broad discretion to make changes or set rules; adding language such as “reasonably” can help ensure decisions are fair. Similarly, when the tenant has obligations, phrases like “commercially reasonable” clarify that you are not required to take on burdensome or costly requirements.

A well-balanced clause will also state that the landlord must maintain the common areas in good repair and in a manner consistent with similar properties in the area, and that no alterations should be allowed that unreasonably interfere with the tenant’s access to or use of their premises.

Security Deposit

This section in a commercial lease outlines the amount of money a tenant must pay upfront to protect the landlord against potential damages, unpaid rent, or breaches of the lease.

Key considerations include making sure the lease requires the landlord to return the deposit within a reasonable period—such as 30 days after lease termination—as long as the tenant has met all obligations. If the required deposit is a large amount, negotiating a “burn-down provision” can be beneficial, allowing the deposit amount to be reduced over time as the tenant establishes a good track record of timely payments and compliance.

Additionally, the lease should clearly state under what circumstances the landlord can use the deposit, and tenants should avoid overly broad language that gives the landlord too much discretion. These protections help ensure that the deposit is fair, transparent, and not an unnecessary strain on the business’s cash flow.

Renewal of Lease Term

This clause outlines a tenant’s right to extend their lease beyond the initial term and is a critical section for long-term business planning. Pay close attention to how renewal options are structured—for example, negotiating two one-year renewal options can provide flexibility, while a single five-year renewal may offer stability but less adaptability.

It’s also important to understand the conditions that must be met in order to renew, such as being current on rent or not being in default, and to note the required timing for providing written notice of intent to renew. Another key point is how rent during the renewal period will be determined. Locking in the rental rate or agreeing on a formula in advance can help a business avoid surprises and make it easier to budget and forecast expenses.

Utilities

This section explains which utilities (such as water, electricity, gas, internet, and trash removal) the tenant is responsible for and how those costs will be billed. In some cases, utilities can be negotiated to be included in the rent. When reviewing this clause, confirm how costs are calculated, whether they are individually metered or shared with other tenants, and whether there are additional service fees. If your lease mentions you will pay for a “reasonable proportion” or “reasonable allocation” clarify how this is calculated. This section is important to review carefully, since utility reliability can significantly affect daily operations and if possible try to include verbiage to minimize your risk for utility stoppage.

Use of Premises

This section defines how you are allowed to use the rented space and sets the boundaries for your business operations. Small businesses should avoid making this description too narrow—for example, instead of stating “coffee shop”, you might want to state the premises will be substantially used for operating a food and beverage business, which gives you flexibility if you later add new services or products.

If the lease references “nuisance,” in this section, review carefully what that means and ensure the landlord must act “reasonably” before claiming your operations are disruptive—this is particularly important if your business involves activities that could be perceived as noisy, odorous, or otherwise intrusive, such as serving alcohol, cooking strong-smelling foods, selling perfume, or running a cigar lounge. In such cases, it’s best to explicitly state in the lease that your specific activity is permitted and not deemed a nuisance.

Additionally, restaurants and other retail businesses may want an “exclusive use provision”, which prevents the landlord from leasing space in the property to direct competitors. While some landlords resist these provisions, many recognize they help tenants succeed. If included, review the remedies carefully to ensure the landlord is obligated to enforce the exclusivity against other tenants if they violate it.

If the lease references “nuisance,” in this section, review carefully what that means and ensure the landlord must act “reasonably” before claiming your operations are disruptive—this is particularly important if your business involves activities that could be perceived as noisy, odorous, or otherwise intrusive, such as serving alcohol, cooking strong-smelling foods, selling perfume, or running a cigar lounge. In such cases, it’s best to explicitly state in the lease that your specific activity is permitted and not deemed a nuisance.

Additionally, restaurants and other retail businesses may want an “exclusive use provision”, which prevents the landlord from leasing space in the property to direct competitors. While some landlords resist these provisions, many recognize they help tenants succeed. If included, review the remedies carefully to ensure the landlord is obligated to enforce the exclusivity against other tenants if they violate it.

Insurance

This section outlines the types of insurance coverage a tenant must carry to protect both the business and the landlord from potential risks. The most common requirements include general liability insurance (to cover accidents or injuries on the premises), property insurance (to protect business equipment and inventory), and sometimes business interruption insurance.Landlords often require tenants to name them as an “additional insured” and designate their coverage as “primary,” meaning the landlord’s own insurance won’t be used until the tenant’s coverage is exhausted.

Small businesses should review this section carefully to understand the specific policies required, the coverage limits, and the costs involved, since these obligations can add significantly to operating expenses. It’s also recommended to consult with an insurance broker to make sure you meet the lease requirements while avoiding unnecessary coverage.

Small businesses should review this section carefully to understand the specific policies required, the coverage limits, and the costs involved, since these obligations can add significantly to operating expenses. It’s also recommended to consult with an insurance broker to make sure you meet the lease requirements while avoiding unnecessary coverage.

Repairs & Maintenance

This section outlines which party is responsible for keeping the premises and building in good condition. Here it’s important to clarify that the landlord is responsible for repairs to the building’s core systems—such as plumbing, electrical, HVAC, and utility lines—that serve multiple tenants. You may also want to include provisions requiring the landlord to maintain the entire building, including common areas, and to handle snow and ice removal from sidewalks and the roof to help reduce liability risks.

Since repairs can impact your ability to operate, consider negotiating a clause that allows you to make necessary repairs yourself if the landlord fails to do so within a reasonable time, and to deduct the cost from your rent. It’s also wise to limit your responsibility for repairing defects in the building’s original construction or improvements made before your tenancy. Lastly, include verbiage regarding any notice you need before the landlord makes repairs that could disrupt your business so you can plan accordingly.

Improvements, Alterations & Additions

This section defines what changes tenants or landlords can make to the space and the conditions under which those changes are allowed. Here it’s important to clarify whether landlord approval is required for your alterations, and if so, negotiate language that their consent “cannot be unreasonably withheld, conditioned, or delayed ” You may also want to include an exception for routine cosmetic updates, such as painting, so you don’t need written approval each time.

Assignment, Subleasing and Transfer of Lease

This section outlines if and how you can transfer your lease obligations to another party. This clause is important because being able to assign (sell) or sublease your space can serve as a valuable back-up option if you decide to close, relocate, or no longer want to pay the rent. Typically, landlords retain significant control over assignments and subleases, and they may not release you from liability unless a new lease is signed with the assignee or subtenant. To protect yourself, consider negotiating carve-outs where landlord consent is not required, such as if your business is sold to a new company or restructured under common ownership. Carefully reviewing this section ensures you have flexibility and a potential exit strategy if your business circumstances change.

Subordination

This section explains that your lease is secondary to the rights of the landlord’s lender. In practice, this means that if the landlord defaults on the loan for the building and the property is foreclosed, the bank could terminate your lease unless additional protections are in place. To avoid this scenario, it’s wise to negotiate a non-disturbance provision, which ensures that your lease will remain in effect even if the property changes ownership. Often, this is addressed through a SNDA (Subordination, Non-Disturbance, and Attornment) Agreement, which balances the rights of the tenant, landlord, and lender. Lenders may also require you to sign a Tenant Estoppel, a document confirming the lease’s terms and that no defaults exist. Reviewing this clause carefully helps small businesses protect their right to stay in the space, even if the landlord runs into financial trouble.

Landlord's Access

This section determines when and how the landlord can enter your premises, typically for inspections, repairs, or improvements. While landlords need reasonable access, small business tenants should ensure the clause includes protections to prevent disruptions to daily operations. For example, you can require that any landlord repairs or alterations not unreasonably interfere with your use, access, or enjoyment of the space, that you receive advance notice before work begins (i.e. - 24 hours advance notice), and that disruptive work be performed outside normal business hours whenever possible. These provisions help balance the landlord’s rights with your ability to run your business without undue interruptions.

Brokerage

This section identifies the real estate brokers involved in the transaction and clarifies how their commissions will be handled. Typically, the lease will state that the landlord is responsible for paying broker fees under a separate written agreement, so tenants don’t bear that cost directly. This section also usually requires the tenant to confirm that they did not work with any other brokers besides those listed, which protects the landlord from potential claims for unpaid commissions. For small businesses, it’s important to review this clause to ensure that the correct brokers are named and that you’re not inadvertently taking on any liability for brokerage fees.

Fire, Casualty, Eminent Domain

This section explains what happens if the premises is damaged by events like fire, natural disasters, or government action (like taking property for public use). Here it’s important to confirm that the lease allows you to terminate if the space suffers substantial damage and the landlord cannot make timely repairs (i.e. - restore the Premises to a condition substantially suitable for the intended use within ninety (90) days).

If not already defined, consider adding language to specify what qualifies as “substantial damage” so there’s no ambiguity. You should also check whether the lease provides for rent abatement—a temporary reduction or suspension of rent—if your business cannot operate fully due to damage. These provisions help protect your financial stability if unexpected events disrupt your ability to use the space.

If not already defined, consider adding language to specify what qualifies as “substantial damage” so there’s no ambiguity. You should also check whether the lease provides for rent abatement—a temporary reduction or suspension of rent—if your business cannot operate fully due to damage. These provisions help protect your financial stability if unexpected events disrupt your ability to use the space.

Default

This section outlines what happens if either party fails to meet their obligations under the lease. Most standard leases focus only on tenant defaults—such as failing to pay rent on time— and it’s up to you to negotiate a landlord default provision and consider whether the landlord has obligations and what remedies you have if they fail to perform, such as reducing rent or even terminating the lease.

It’s also important to ensure that if you are required to reimburse the landlord for expenses, those costs are clearly limited to reasonable expenses. In addition, consider negotiating a clause that requires the landlord to mitigate damages (for example, by re-leasing the space if you default) rather than leaving you liable for the entire lease term. Carefully reviewing this section helps balance accountability on both sides and limits your financial risk.

It’s also important to ensure that if you are required to reimburse the landlord for expenses, those costs are clearly limited to reasonable expenses. In addition, consider negotiating a clause that requires the landlord to mitigate damages (for example, by re-leasing the space if you default) rather than leaving you liable for the entire lease term. Carefully reviewing this section helps balance accountability on both sides and limits your financial risk.

Termination

This section lays out the circumstances under which the lease can end early. Some leases include an “early termination” option that allows tenants to end the lease with advance notice (often six months) and payment of a fee. As a small business owner, you might also negotiate for a termination right tied to specific business performance, such as the ability to exit the lease if you are unable to reach a certain level of sales during a certain period. Reviewing this clause carefully gives you flexibility and an exit strategy, helping reduce the risk of being locked into a long-term commitment that no longer makes financial sense for your business.

Surrender

This section explains the condition in which you must return the premises to the landlord at the end of your lease. It’s important to clarify whether you must remove improvements or alterations you made, or if they can remain. Without clear terms, you could face unexpected costs to restore the space to its original condition.

Holding Over

This section addresses what happens if you stay in the space after your lease term ends without signing a renewal or new agreement. Typically, landlords will charge a premium rent—often 125% to 200% of your last monthly rent—during this period. For small businesses, it’s important to negotiate a reasonable holdover rate, since unexpected delays in moving or build-out of a new location can make short-term occupancy necessary. You should also ensure the lease specifies whether the holdover creates a month-to-month tenancy rather than automatically extending the full lease term. Understanding this provision helps you plan transitions smoothly and avoid steep, unanticipated costs.

Indemnification

This section outlines how a tenant may be required to protect, defend, and reimburse the landlord if claims, damages, or lawsuits arise in connection with the tenant’s use of the property. For example, if a passerby slips and falls on ice outside the property and sues, the indemnification clause could make the tenant financially responsible. Small businesses should pay close attention to this provision to ensure it does not expose them to unlimited liability. A key consideration is negotiating an exception so the tenant is not responsible for damages caused by the landlord’s negligence or willful misconduct, such as failing to maintain the building’s structure or common areas.

A negotiation strategy is to start by asking for mutual indemnification (the fairest outcome where each party is responsible for their own actions) and, if the landlord refuses, fall back to a tenant-favorable clause to reduce your liability but this doesn’t give you much protection if the landlord is at fault. This could help strike a fair balance and prevent the tenant from being held liable for issues beyond their control.

Hazardous Materials

This section addresses how hazardous or toxic substances are handled on the property and allocates responsibility between landlord and tenant. For a small business, it’s important to understand that you could be held responsible for cleanup costs, fines, or damages if hazardous substances are introduced or improperly managed—even unintentionally. When reviewing this clause, consider adding language clarifying that it does not apply to ordinary, everyday items (like cleaning supplies or office products) that might technically fall under the definition of “Hazardous Substance.” Additionally, because tenants are often made responsible for inspection or remediation costs, you may want to negotiate a provision requiring the landlord to confirm that no hazardous substances are currently present in the building. This helps protect you from inheriting liability for issues that existed before your tenancy.

Force Majeure

This section addresses unexpected events beyond either party’s control—such as natural disasters, government actions, pandemics, or labor strikes—that could prevent timely performance of lease obligations.

For landlords, this typically excuses delays in making repairs or providing services; for tenants, it may excuse delays in opening for business or performing certain non-monetary obligations.

Many standard clauses specifically exclude the tenant’s rent payment obligations, meaning you would still be required to pay rent even if a force majeure event disrupts your business. As a small business, you should carefully review this clause to see whether rent obligations are carved out, and consider negotiating for rent abatement, deferral, or termination rights if a force majeure event substantially impacts your ability to operate. This balance can provide important protection during circumstances outside your control.

These are just some of the most common clauses you’re likely to encounter in a commercial lease, but there may be other miscellaneous clauses and it would be important to have a licensed professional review your lease to ensure you’re okay with the agreement in its entirety.

Negotiating Tips & Lease Checklist

At the end of the day, landlords will often present a pre-printed contract with language favoring their interests and it is up to the tenant to to negotiate the terms that they deem acceptable.

Many small business owners view leasing with a fixed mindset, believing they have to accept the landlord’s terms exactly as written or walk away. The truth is, commercial leases are rarely one-size-fits-all. Landlords want long-term, stable tenants, and that gives you negotiating power.

When negotiating, preparation and prioritization are essential. Let’s face it, out of all the places you’ve looked at (and there should be a lot) there will be a laundry list of things you’re going to want to negotiate. Once you have that list, you’ll need to sit down and prioritize the areas that are most important to you BEFORE you enter into any negotiations. And in order to have a healthy negotiation you need to have all the facts, or at least as much as you can realistically get, to be able to prioritize your list.

So, whether it’s adjusting rent escalations, negotiating for tenant improvements, or securing renewal options, almost every lease term is open to discussion. Enter the process with the mindset that this is a partnership, not a handout — both sides benefit when the deal works for everyone.

Below is a checklist of things we’ve addressed to help you organize your approach, but you’ll need to compare this list with your need-to-have’s and nice-to-have’s list we discussed in the beginning.

Pre-Lease

-

Complete financial forecast to confirm affordability and break-even point.

-

Developed a list of need/nice-to-haves

-

Engaged a tenant-rep broker that specializes in your space type (retail, office, industrial, etc.)

-

Research tenant improvement contractors

Zoning, Permits & Premises

-

City zoning/building departments allow your business here.

-

Consulted city Economic Development staff.

-

Health dept. approval confirmed, if applicable

-

Fire department approval confirmed.

-

Lease clause makes landlord responsible if facility isn’t up to code.

-

Protected from liability for pre-existing hazardous substances.

-

Premises delivered in good, clean, tenantable condition with working systems.

Facility & Utility Assessment

-

Sufficient power and outlets.

-

Adequate parking for staff/customers.

-

Proper HVAC, lighting, no roof leaks.

-

Burglary risk/cost acceptable and building secure.

-

Utilities individually metered or fair allocation method defined.

Lease Structure & Expenses

-

Lease type understood (Gross, Net, NNN, Modified Gross, Percentage).

-

Clear on responsibility for taxes, insurance, maintenance, utilities, sewer.

-

“Gross sales” definition excludes sales taxes/tips (if percentage lease).

-

No “without limitations” language in expenses.

Rent, Escalations & Protections

-

Lease start date & date of possession clear.

-

Cap rent increases at X% or tied to CPI with justification.

-

Only pay pro-rata share of increases.

-

Landlord must provide escalation documentation.

-

Negotiated free/abated rent during build-out.

-

Fully understand risks of personal guarantee.

Lease & Business Identity

-

Lease reviewed by real estate attorney.

-

Property description and drawings attached.

-

Landlord’s responsibilities for improvements listed.

-

Business entity (LLC, Corp.) listed as Lessee (not personal name).

-

All negotiated changes written into lease.

-

Original signed copy retained.

Use of Premises & Competition

-

Use description broad enough for future flexibility.

-

Lease confirms activities (e.g., cigar lounge, serving alcohol) are permitted.

-

Exclusive use clause prevents competitors in same center.

-

Co-tenancy clause included (protection if anchor tenants leave).

-

Operating hours align with business model.

Repairs, Maintenance & Improvements

-

Landlord responsible for core systems (HVAC, plumbing, electrical).

-

Self-help clause allows tenant to repair/deduct if landlord fails.

-

Landlord consent for improvements cannot be unreasonably withheld.

-

Surrender conditions defined (clarify removal vs. keeping improvements).

-

Move-out restoration costs understood.

Relocation & Landlord Access

-

If relocated, landlord covers all moving, printing, phone costs, etc.

-

Rent in new location cannot increase.

-

Right to refuse relocation in final lease year.

-

Landlord must give advance notice (e.g., 24 hrs) before entering.

-

Disruptive work performed outside business hours.

Subleasing, Assignment & Exit

-

Sublease/assignment fees negotiated down.

-

Carve-outs for assignment without consent (e.g., sale/restructure).

-

Early termination clause negotiated.

-

Holdover rate capped (125–200%).

-

Holdover creates month-to-month tenancy, not full extension.

Renewal Options

-

Clear renewal option included.

-

Renewal structure defined (e.g., 2 x 1-year vs. 1 x 5-year).

-

Renewal rent formula pre-set or capped.

-

Written notice timing requirements noted.

Security Deposit

-

Negotiated for reduced deposit or burndown provision.

-

Letter of credit considered if cash is tight.

-

Interest on deposit addressed.

-

Landlord must return deposit (minus normal wear/tear) within 30 days.

Catastrophe & Default

-

Remedies for landlord default included.

-

Rent abatement in case of fire/casualty/force majeure.

-

Tenant not liable for landlord negligence or misconduct.

-

Landlord required to mitigate damages if tenant defaults.

-

Non-Disturbance Agreement (SNDA) in place for foreclosure protection.

Funded in part through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, conclusions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

Social accounts

Get in touch

-

2180 Third Street, La Verne, CA, 91750

-

SBDC@laverne.edu

-

(909)448-1567

Our Newsletter

Get updates on live streams, news, tips, resources and more.

Thank you!

Copyright © 2023