Master Your Digital Ad Budget

If you are looking to break into online ads like facebook or Google then you will need to set aside some money for your ad spend budget. The biggest question is how are you supposed to know how much to spend? In this article, I’ll show how to calculate your online advertising budget and track your key metrics to save money for your business.

Determine Revenue Goal

When it comes to anything related to marketing, before you start crafting a strategy or ad budget, you need to determine your revenue goal. So what does that mean? You need to know how much you want to make for revenue. For example our revenue goal is and additional $10,000 and let’s say our product price is $100. To figure how many unit we need to sell we will use this formula:

REVENUE GOAL / PRICE OF THE OFFER = # OF UNITS TO SELL

So let’s plugin our $10,000 divided by $100 price per unit, so we will need to sell 100 units this year or about 9 units a month. At this point you will need to know if this is doable or if you need to adjust your revenue goal.

$10,000 / $100 per unit = 100 units to sell

Identify Sales conversions

Once you have an attainable revenue goal you need to identify your sales conversions. A sales conversion is fairly simple to calculate and you don't need to have run ads before. So if you have this data, you definitely want to use it. Use this formula to calculate sales conversions:

# OF SALES FROM LEADS / TOTAL LEADS OR LANDING PAGE VIEWS = % SALES CONVERSION

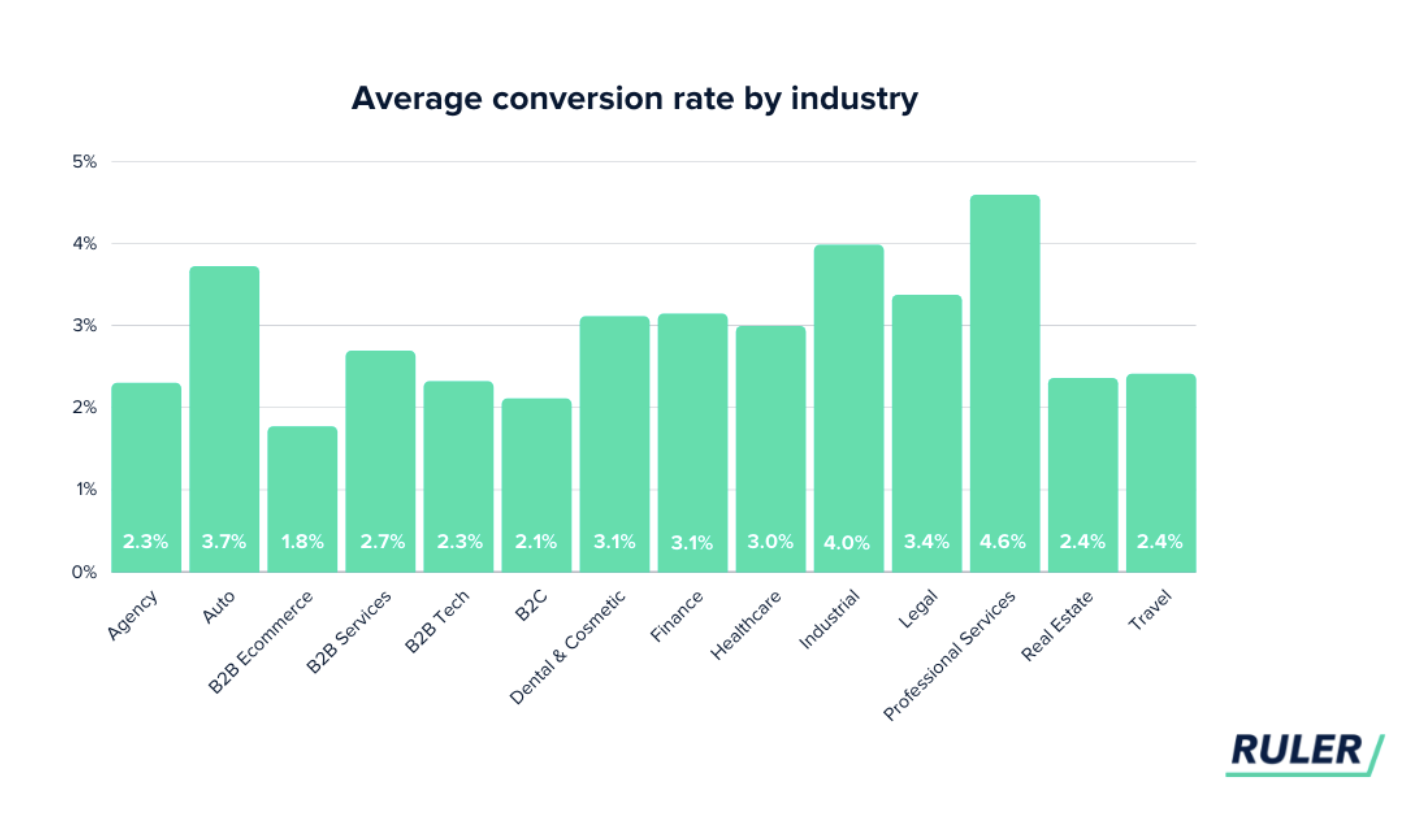

Let’s break this down. If you normally get some leads from facebook or finding you on google you need to know what percentage of the total are actually buying. If you don’t have conversion rate data, here are average conversion rates by industry to estimate for your kind of business:

So let’s say we get 100 people checking out our facebook ad or Google ad per month. We find out that only 5 of these people actually buy our products, then we would have a 5% sales conversion. That’s it. It's an easy metric to determine how well you are doing.

# OF SALES NEEDED / % SALES CONVERSION X 100 = # OF LEADS OR LANDING PAGE VIEWS NEEDED

So we already have some numbers needed for this. We just need to know how to put it together. So we know you need to sell 100 units to reach your revenue of $10,000 and your sales conversion is 5% for this example. Let’s calculate 100 units needed to sell divided by our sale conversion at 5% times 100 equals 200 leads or 17 per month. This means your ad should generate this many leads or hits on your landing page from your ecommerce store to make the amount of sales you need.

$10,000 / 5% Conversion Rate X 100 = 200 Leads Per Year or 17 Leads Per Month

Cost Per Lead

Before we are able to finish our ad budget calculation you need to know what your Cost Per Lead (CPL) is going to be. The cost per lead is the amount you are pay for a particular lead to enter your funnel. This is a handy calculation to control your costs and understand your marketing budget like we are here. If you already have this information use that, but if want to calculate it in some way you would use:

TOTAL COST OF LEADS / NUMBER OF LEADS= COST PER LEAD

This is a mandatory calculation that many business owners don't even have! This is primarily for Google Ads so the estimates are going to be a little higher than Facebook. Also if you are driving people to a landing page, you will have a lower CPL because of the automation where the upper estimate will be for those if a sales call or presentation is required. Just so you know where your estimate may fall.

Ad Budget

Ok, we have all the components needed to figure out our ad budget. We will use this formula to calculate it:

# OF SALES / SALES CONVERSION % = # OF LEADS X COST PER LEAD = AD SPEND BUDGET

Let’s take our number of sales we determined would make our revenue goal of $10,000 for the year, 100 units. We figured out our sales conversion was 5% based on our analytics but your number can change. This will be your number of leads at 200 per year times the cost per lead at let’s say $5.

100 UNITS / 5% = 200 LEADS X $5 = $1000 PER YEAR OR ROUGHLY $84/ PER MONTH.

If you are looking at these numbers and saying to yourself “I can’t afford this ad budget”, there is something you can do. You can adjust your formula until your budget matches what you deem is acceptable for your business and or work the formula backwards to get the desired result.

Final Thoughts

Determining your ad budget to reach your revenue goals is one of the hardest things to grasp as a small business owner. It takes a certain amount of diligence to track your metrics and maximize the money you need to spend and not waste it. You shouldn’t be afraid to adjust your budget and be willing to gather data like your sales conversions and cost per lead so you can best measure your advertising effectiveness.

Social accounts

Get in touch

-

2180 Third Street, La Verne, CA, 91750

-

SBDC@laverne.edu

-

(909)448-1567