Lean Start-Up: Bootstrapping Your Small Business

You’re trying to launch a business with barely enough money to cover groceries—let alone branding, software, or ads. You’re wondering if bootstrapping is just a polite way of saying you're broke and burning out. And you’re not alone. A lot of people feel that way in the beginning.

What is Bootstrapping, Really? Beyond "No Money"

Let’s bust a myth real quick. Bootstrapping doesn’t mean you’ve got nothing. It means you’re not relying on outside investors or big bank loans. You're building your business with your own hands, your own cash, and—most importantly—your own decisions.

You get to keep 100% of what you build. You answer to your customers, not a board of investors. You learn how to stretch a dollar and that makes you sharp—dangerously sharp. It’s your business, your pace, your rules.

So Why Bootstrap When Funding Looks So Easy?

Good question. Everyone’s chasing funding like it’s the golden ticket. But guess what? When you bootstrap, you keep the keys to your kingdom. No giving away slices of your dream just to get a check.

And you know what else? You’ll make better decisions. Every dollar matters, so you think hard before you spend it. That discipline builds a business that can weather storms.

Plus, you’re not chasing investors—you’re solving real problems for real customers. That’s what builds loyalty. That’s what lasts.

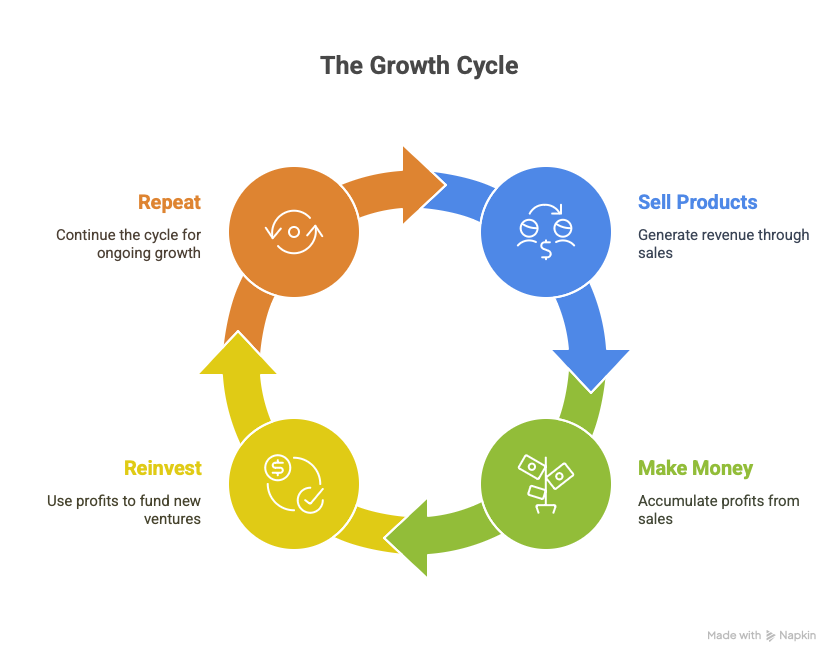

The "Revenue Recycler" in Action: Unlocking Untapped Capital

Here’s the magic: take every dollar that comes in and use it to grow the next thing. Sell something → make money → reinvest → repeat. That’s the cycle. That’s how you create momentum without loans.

1. Get Paid First: Customer Capital

Why wait to build something before you sell it? Flip that idea. Sell it first—through presales or pre-orders. If people are willing to pay now, you’ve got proof that your idea works.

2. Run Lean and Think Sharp

You don’t need a fancy office. Work from home, a library, or a co-working space. Use free or cheap tools—Notion, Canva, Zapier. Learn no-code platforms. Automate what you can.

Barter if you must. Trade your skills for someone else’s. Need branding? Offer bookkeeping. Need web design? Offer photography. People are more open to trade than you think.

3. Leverage Relationships That Move the Needle

Thinking about asking friends or family for help? Do it. Just be upfront. Put everything in writing—every dollar, every expectation.

Don’t go it alone. Partner with other businesses. Share your audience. Host events together. Split software. You’ll save money and build goodwill.

Your Blueprint for Planning and Money Smarts

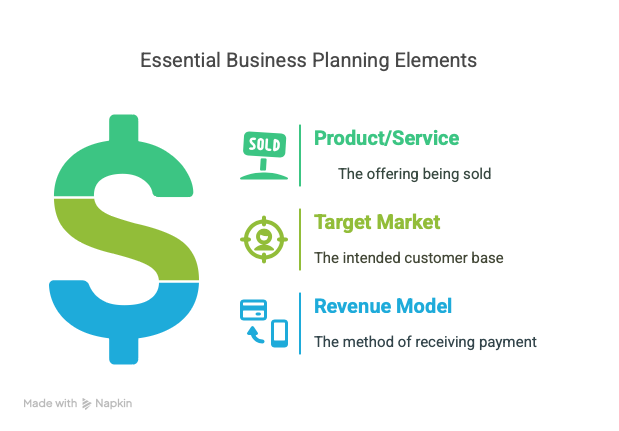

The Power of a Lean Business Plan:

Don’t write a 30-page business plan. Create a one-page game plan:

Then budget hard. Essentials only. Track every cent. Cash flow is everything—if you run out of it, you’re done.

Set Real Goals. Track Real Results

Forget vanity metrics. Focus on what moves the needle—how much you spend to get a customer (CAC), how much they spend over time (LTV), how many stick around.

Want to grow? Test small. Try that new ad campaign with $50. See what works before you go all in.

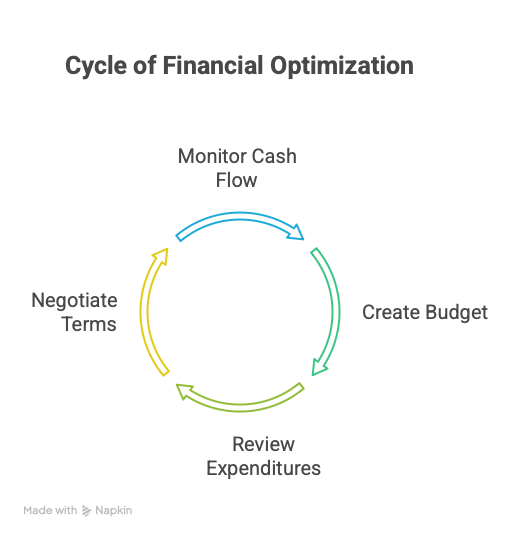

Effective Budgeting: Create a detailed budget and stick to it, regularly reviewing expenditures and cutting unnecessary costs.

Cash Flow is King: Rigorously monitor cash inflows and outflows to ensure liquidity and avoid difficulties.

And when profits come in? Reinvest smart. Put money into what brings money back.

Start With What You’ve Got (Because You’ve Got More Than You Think)

Personal Savings and Credit: Use your own funds, 401(k), or leverage personal credit cards with 0% APR periods, being mindful of personal financial risk.

Utilize Self-Directed IRAs: Structure loans or equity from retirement funds.

Keep Your Day Job: Maintain steady income to reduce financial pressure in early stages.

Marketing on a Tight Budget (Still Works!)

You don’t need a marketing team. You need a message. Speak to your audience’s biggest pain point and show them how you solve it.

Start with content—blog posts, Instagram reels, short videos. Share stories. Share results. Build trust.

Ask for reviews. Turn customers into cheerleaders. Offer referral rewards. Run a flash sale. Host a free workshop. Record it. Reuse it.

Marketing is just talking to people. Keep it real. Keep it helpful.

Build a Team That Gets It

You don’t need a huge staff. You need the right people. People who wear a few hats and believe in what you’re building.

Freelancers and contractors are a great way to stay flexible. Can’t afford them? Offer a small equity slice. You’d be surprised how many are open to that.

It’s not about resumes—it’s about resilience, trust, and shared ambition.

Launch Ugly. Fix Fast.

Don’t wait for perfection. Create your MVP (minimum viable product)—something basic that solves a problem. Launch it. Collect feedback. Make it better.

Look for extra revenue streams: a digital guide, a consulting session, a paid community. Test it. If it works, keep it. Listen to your customers. They’ll tell you what to build next.

Final Thoughts

You’re not stuck. You’re scrappy. That’s your strength.

Bootstrapping is tough, but it’s also freeing. No one owns you. You’re learning, growing, and building something that’s 100% yours. One dollar at a time.

This journey? It’s yours. And it’s worth it. So—start now. Start messy. Start with what you have. And grow with what you earn. Because you’ve got this. And scrappy looks good on you.

Social accounts

Get in touch

-

2180 Third Street, La Verne, CA, 91750

-

SBDC@laverne.edu

-

(909)448-1567